This article was last updated on February 10, 2023.

The IRS has an entire decade to collect your taxes. So, whether you owe $5,000 or $50,000 it’s best to start paying down your bill as soon as possible. Avoiding payment can lead to the IRS taking money directly from your wages or bank account, or even putting a federal tax lien against your property, which may impact your ability to take out loans, access your home equity, and more.

If you owe money this year or from prior years—don’t panic. Here are some important updates and options to get your finances back on track.

What’s New for 2023 Tax Season (for the 2022 tax year)

Important Tax Dates:

- April 18: Filing deadline for most U.S. residents

- October 16: Filing deadline if you were granted an extension

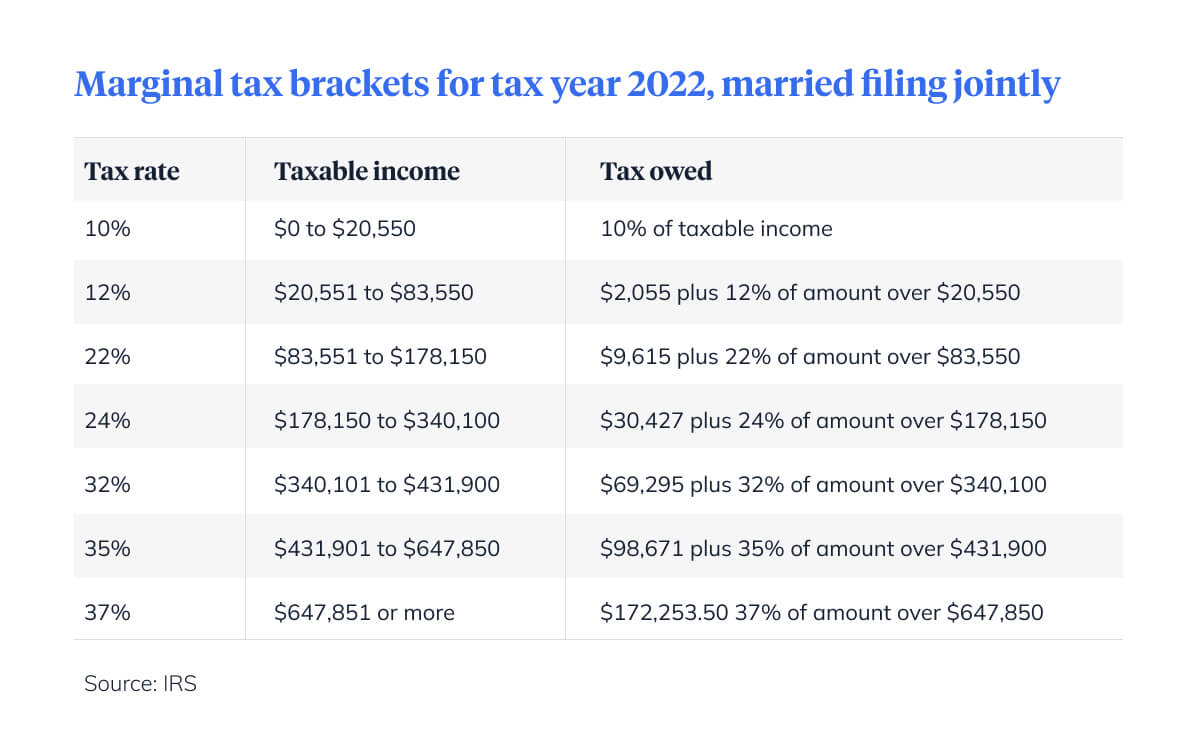

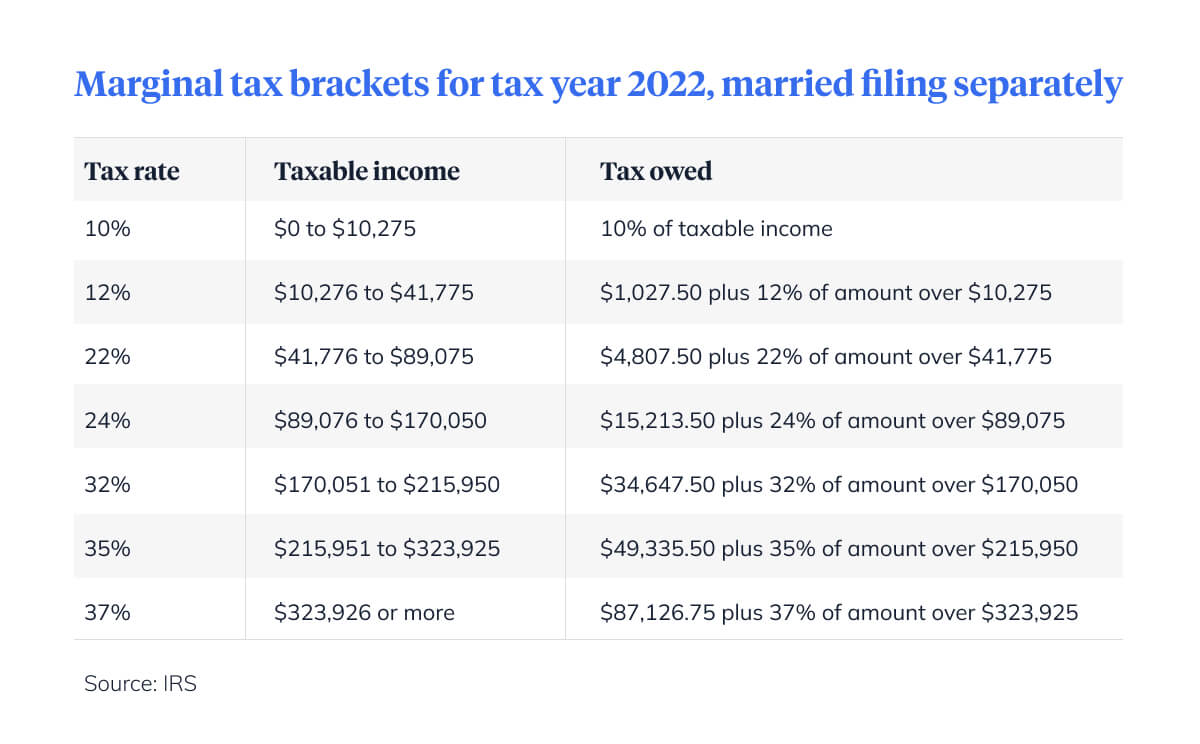

2022 Tax Bracket Updates

The federal income tax brackets have changed for 2022, so your first step should be understanding what bracket you fall into this year.

Form 1099-K Reporting Changes

If you received any third party payments in 2022 for goods or services that exceeded $600, you’ll get a Form 1099-K for payment card and third party transactions that you’ll need to fill out. However, personal reimbursements or gifts from family or friends received through third party platforms are not taxable. In previous years, Form 1099-K was only issued if a taxpayer completed more than 200 transactions in a year that totalled more than $20,000.

Smaller Returns

Overall, largely due to the scaling back of tax credits to 2019 levels — including the Child Tax Credit, Earned Income Tax Credit, and the Child and Dependent Care Credit — you can expect a lower return than in previous years.

No Above-the-Line Charitable Deductions

Another change for the 2022 tax season is that taxpayers are no longer able to deduct up to $600 for charitable donations like they were in 2021.

Premium Tax Credit Updates

While many of the adjustments for this tax season have restricted or narrowed eligibility and credit amounts, the premium tax credit may actually be available to more 2022 taxpayers due to the expanded criteria. For 2022, to be eligible, you must:

- Have a qualifying household income amount

- Not be claimed as a dependent by another person

- Not file your return under the status of Married Filing Separately (except in certain circumstances involving domestic abuse or spousal abandonment)

- Meet certain requirements around health insurance

Clean Vehicle Credit Updates

You may be eligible for a nonrefundable credit of up to $7,500 if you purchased a qualifying, new plug-in electric vehicle for your own use in 2022 or prior.

Child Tax Credit Updates

For the 2022 tax year, the child tax credit has reverted to $2,000 per child under age 17 who is claimed as a dependent on your return. Note that if your modified adjusted gross income (AGI) exceeds $400,000 on a joint return or $200,000 on a single/head-of-household return, your credit amount will be reduced by $50 for each $1,000 you earn beyond this threshold.

Finally, the credit is no longer fully refundable in most cases — except for select lower-income taxpayers, for whom up to $1,500 may be refunded.

If you owe more than you expected this tax season, there are a few things you can do to alleviate the financial burden.

1. File—Even if You Can’t Pay in Full

As you get ready to prep your 2022 taxes—and any back taxes you still need to file—remember that filing can help reduce the amount of money you owe in the long run. As H&R Block notes, the IRS imposes a hefty “failure to file” penalty, equal to 5% of the unpaid balance each month, up to 25% of your unpaid taxes. With the added penalties, that means the interest accruing on your unpaid taxes will be higher, too.

2. Request an Extension

If you need more time to organize files for your taxes, or come up with a game plan because you know you owe more than you can pay, you can file for a six-month extension.

While filing an extension for your 2022 taxes doesn’t buy you more time for paying taxes (you still need to estimate the amount you owe and pay it), it does ensure you won’t begin to accrue late-filing or late payment penalties right away. As TurboTax explains, “if you pay less than 90% of the tax you owe, you’ll end up owing a penalty of 0.5% of the underpayment every month” until your balance is paid.

3. Explore IRS Payment Options

The IRS allows multiple options for paying your taxes. You may even be able to temporarily delay collection of your taxes based on your financial situation. You can also set up a short- and long-term payment plan. Each has an application fee that varies depending on your plan and financial status. However, note that interest and other penalties that will continue to add up for either of these options as long as you have an outstanding balance. The IRS interest rates are subject to change quarterly.

Another option may be to file an Offer in Compromise that allows you to settle your IRS debt for an amount that’s less than the total you owe. If you’re a homeowner, you may find your home — likely your biggest asset — disqualifies you. Since you have equity in your home, the IRS sees that as means to pay your taxes.

4. Access Your Home Equity to Help with Taxes

Not paying your taxes can result in a lien on your home, making it harder — if not impossible—to access your home equity. But you can access your home equity to settle your debt before a lien is placed on your home.

Paying off your taxes with a home equity loan, especially if you owe more than you can pay off in a single credit card payment, allows you to avoid taking on bad debt. Unlike credit cards that average more than 16% interest, a home equity loan only averages 5.82%. When you file, you’ll know the lump sum you owe, which may make a home equity loan more appealing than a home equity line of credit (HELOC). With either, you’ll want to make sure you can afford payments, as you risk foreclosure if you can’t make your payments.

Note that following the 2017 Tax Cuts and Jobs Act, the interest you pay on a home equity loan or HELOC is no longer tax deductible if you use it for paying off taxes. Interest on these loans, as U.S. News & World Report explains, only qualifies for a tax deduction if you use the loans to make home improvements.

Read HELOCs & Home Equity Loans: What’s the Difference and Is Either Right for You? for more on how these two differ >>

Another option is accessing your home equity via a home equity investment. Unlike a loan, a home equity investment gives you cash now in exchange for a share of the future value of your home.

Since it’s an investment, rather than a loan, there are no monthly payments and there is no interest. Instead, you settle the investment when you sell your home or buy out the investment. Plus, with home equity investments from companies like Hometap, your debt-to-income ratio isn’t a qualification factor as it is with home equity loans.

You should always do the research and the math to find out which payment method works best for your financial situation. You may find accessing your equity is a more affordable way to pay off your taxes than the IRS payment plan—or vice versa.

See if you pre-qualify for a Hometap Investment in less than 30 seconds.

YOU SHOULD KNOW…

The opinions expressed in this post are for informational purposes only. To determine the best financing for your personal circumstances and goals, consult with a licensed advisor.