With the average cost of a college education at $10,740 and $38,070 per year for public and private institutions respectively, and rising by the year, it’s no surprise that the typical student loan borrower owes $28,950, and more than half of all students from public institutions (55%) have student loans. Currently, national student debt totals $1.75 trillion, with individuals ages 25–34 saddled with the brunt of it; this group owes a collective $500 billion in debt.

Today, the federal student loan program consists of direct subsidized loans, which provide up to $5,500 to undergraduate students in need. For loans that were disbursed on or after July 1, 2022 and before July 1, 2023, the interest rate is 4.99%. There are also direct unsubsidized loans that don’t require financial need and provide undergraduate, graduate, and professional degree students with up to $20,500 in funding. Like the subsidized loans, the interest rate is 4.99% for undergraduate students, but is higher for graduate and professional degree students at 6.54%. In March 2020, the federal government paused student loan payments. That pause has been extended until at least January 2023.

Student Loan Forgiveness Proposed — And Blocked

On August 24, 2022, President Biden announced a planned student loan forgiveness program that cancels up to $20,000 in debt for Pell Grant recipients, which includes those with direct student loans as well as select Perkins and FFEL loans, and up to $10,000 for non-Pell Grant recipients.

There were some established criteria applicants needed to meet in order to qualify for this program, including an adjusted gross income (AGI) of less than $125,000 for individuals, and $250,000 for married couples and head-of-household. This income cap could be based on either 2020 or 2021 federal tax returns. Those who had private student loans would be ineligible. However, only 8% of student loans are private, allowing the vast majority of loan recipients to potentially take advantage of the forgiveness program as long as they met the income requirements.

In mid-October, the Department of Education published the student loan forgiveness application, which was fairly short and didn’t require any additional documents or a Federal Student Aid (FSA) ID, prompting millions of individuals with loans to apply.

However, on November 10, 2022, a federal judge in Texas struck down Biden’s forgiveness program, stating that it was illegal. This was after another legal challenge had also stopped the program in its tracks. While the Justice Department plans to appeal this ruling and hopes to provide the 16 million previously approved borrowers with expedited relief if and when the ruling is overturned, those who are in need of quicker financial assistance might be seeking ways to begin making progress toward eliminating student debt in the meantime — and even after receiving loan forgiveness if they owe more than the $10–20,000. There are also those who don’t meet the income requirements that are still in search of solutions to eliminate their student debt.

An Alternative Option to Pay Down Student Loans

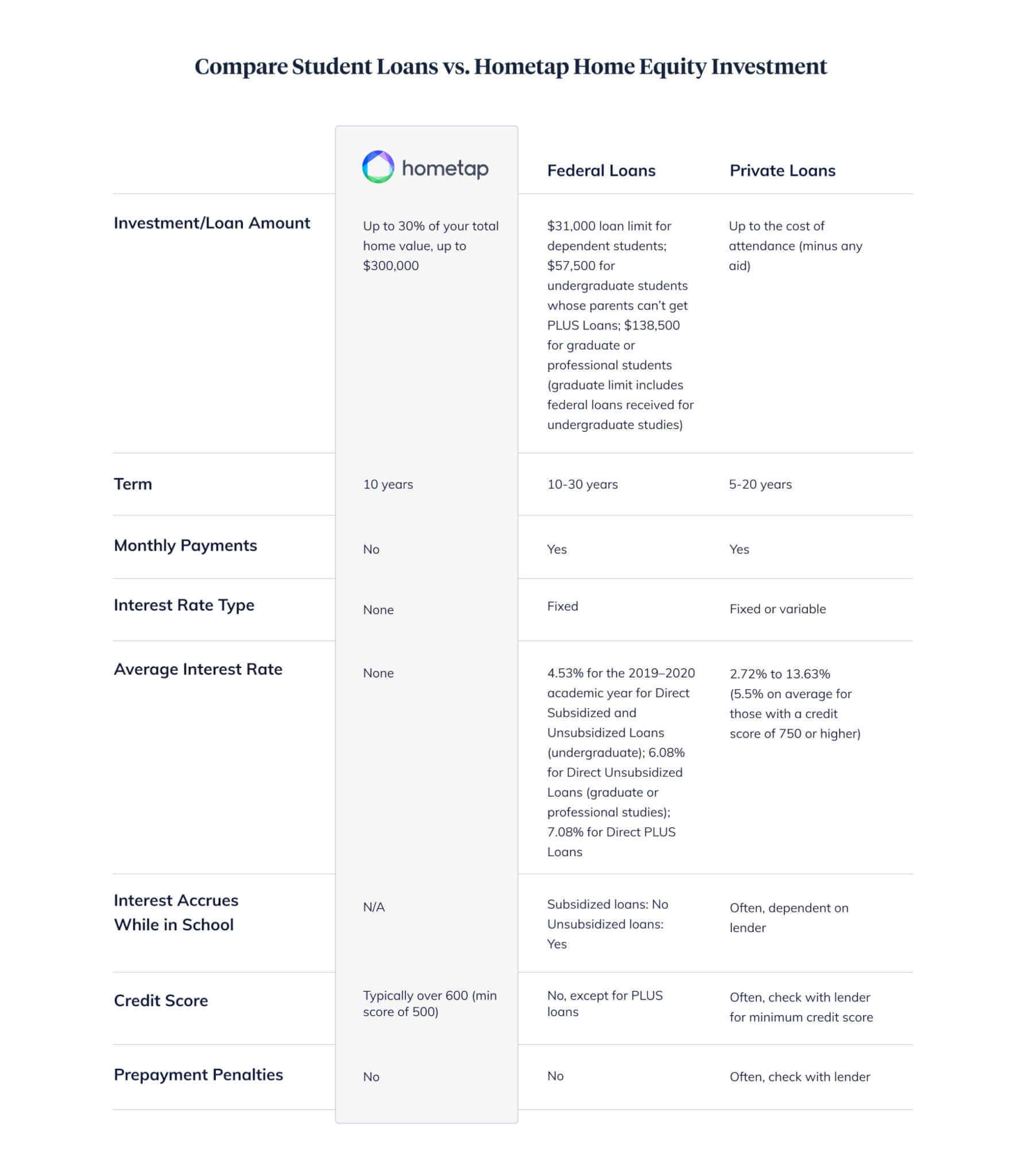

If you’re a homeowner, a home equity investment (HEI) can be an ideal way to get rid of student debt depending on your personal goals and situation. Not only is it a good way to potentially take advantage of the recent record high amounts of home equity, but because there isn’t any interest or monthly payments, you can potentially pay off your own or your child’s loans more quickly than with other options. If the loan forgiveness program pushes through and you still have an outstanding balance beyond the maximum relief cap, a HEI could help pay it off. And there aren’t any restrictions on how the funds are used, so you can accomplish other financial goals like paying off credit card debt or making home repairs.

Plus, the effective period of a Hometap Investment is 10 years, giving you time to handle bigger financial priorities before beginning to pay off loans, or vice versa.

Take our five-minute quiz to see if a Hometap Investment might be a good way for you to begin eliminating student loan debt.

YOU SHOULD KNOW…

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.