When it comes to retirement planning for women, some of the current stats may surprise you. Nearly one third of adult women (29%) don’t have a retirement strategy in place. The figures around what percentage of women invest in their retirement are similar: the Teachers Insurance and Annuity Association (TIAA) recently found that just 31% of those surveyed are saving for retirement, as opposed to 44% of men. This information is especially concerning, considering that women live longer than men on average, typically earn less than men during the span of their career, and receive fewer retirement benefits on the whole than men as well.

As a result, they may be able to invest less overall than men, regardless of when they begin putting aside money. They tend to retire earlier, too; the average retirement age for women is 62.3, whereas for men it’s 64.6.

But If you’re a woman who has yet to start saving for retirement, it’s not too late. While it can seem overwhelming to know where to start, taking it step by step can make the process much more manageable and less stressful.

Enlist the Help of a Financial Planner

Experts recommend first meeting with a financial advisor. If your employer provides a retirement plan like a 401(k), you can likely connect with that company, and they can refer you to an in-house planner who can begin working with you to establish retirement goals and help you make strides toward reaching them.

Decide on Your Approach

There are a few different schools of thought when it comes to determining the amount of money you’ll need to retire. Here are the most common ones:

Strategy #1: The End Result

This approach holds that you should save 10 to 12 times your annual income by retirement age. While this is wise, you’ll want to make sure you have some more granular milestones in place to keep yourself on track (see below).

Strategy #2: Pace Yourself

A pacing plan takes the above idea a little further, advising that your savings should be equivalent to a multiple of your annual income as you age. For example, by age 30, you should have set aside as much as you’re making per year. By age 40, your retirement fund should be equal to three times your salary, six times by age 50, and so on — leading to 10–12 times your salary by age 67.

Strategy #3: Percentage Plan

Similar to strategy #1, this approach advises that you should have saved enough money to replace 60–100% of your pre-retirement annual income by the time you retire.

Strategy #4: Who Wants to Be a Millionaire?

This is probably the most basic rule, that generally suggests aspiring retirees should have a million dollars in the bank before they stop working. Yet, these days, this thinking is a bit outdated — as a million dollars certainly doesn’t go as far as it did 20 or 30 years ago. While it may be a good initial goal for some, you’ll want to take a look at your own current and desired lifestyle to roughly estimate your ideal savings amount in order to live most comfortably.

Retirement Tips for Women

Regardless of what plan you choose, the earlier you begin putting money away for retirement, the better. An easy way to get started, even prior to meeting with a financial advisor, is to automate your 401(k), 403(b), or IRA contributions; whatever you can afford to contribute to begin with helps.

In addition, as you approach retirement age, it can also be valuable to look at the ways in which you can optimize social security and maximize your benefits, as social security benefits represent 30% of retirement income for elderly individuals. However, the amount you’re eligible for depends on when you choose to collect your benefits, as well as factors like Medicare deductions and your spouse.

Finally, it’s important to consider your lifestyle goals for retirement. For example, if your plan is to downsize and live pretty frugally, you can aim for a lower savings target. On the other hand, if you want to travel far and wide or treat yourself to luxury vacations, consider ballparking what that might look like for you cost-wise and plan accordingly.

Explore Retirement Resources

Fortunately, there are a number of resources centered around women and retirement savings that are designed for those looking to begin their investing journey, including Ellevest, a wealth management app designed by women, and Female Invest.

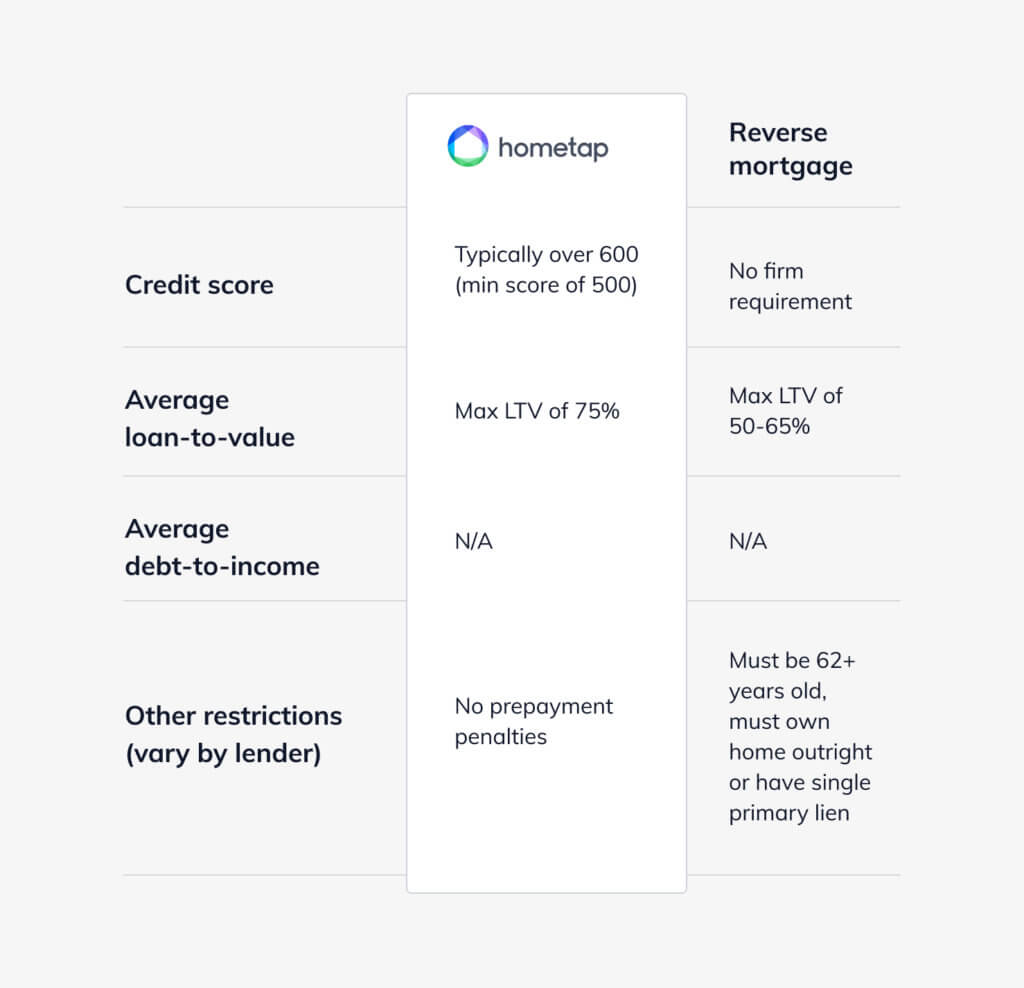

If you need to pay down debt or take care of other financial obligations so you can begin saving for retirement, a home equity investment might be able to help you access the cash you need, all without interest or monthly payments.

Take our five-minute quiz to see if a Hometap Investment might make sense for you as you plan for retirement.

YOU SHOULD KNOW…

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.