Deciding whether to save or pay off debt is a very personal choice — and one that depends on many different factors. However, there are a number of ways to weigh your options in order to pick the best one for you. Below, we’ll cover the pros and cons of each route so you can more confidently answer the question: should I pay off debt or save?

Option 1: Pay Off Debt

Advantages to paying off debt include reducing the amount of interest you’re paying over time, improving your credit score, and lessening the stress and psychological burden that comes along with having the cloud of unpaid financial obligations hanging over your head. It also might make more sense to focus on getting rid of debt if it can help you accomplish some long-held financial goals.

In terms of choosing whether to pay off debt or invest, it may help to know that experts generally advise that if the total interest rate on your debt is greater than 6%, you should pay it down first before focusing on savings or investing.

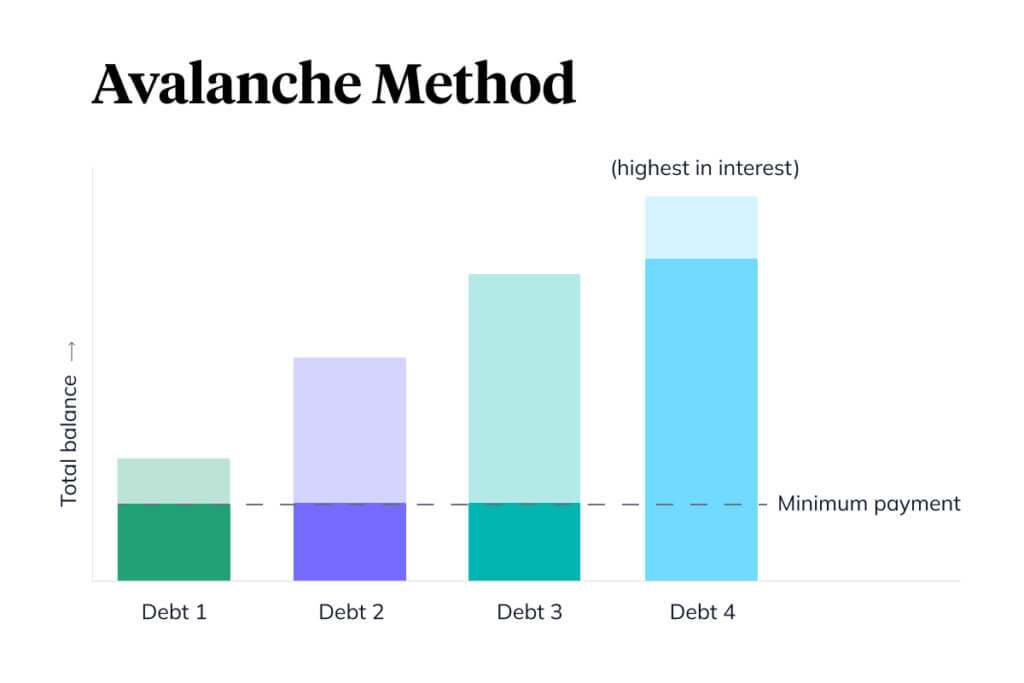

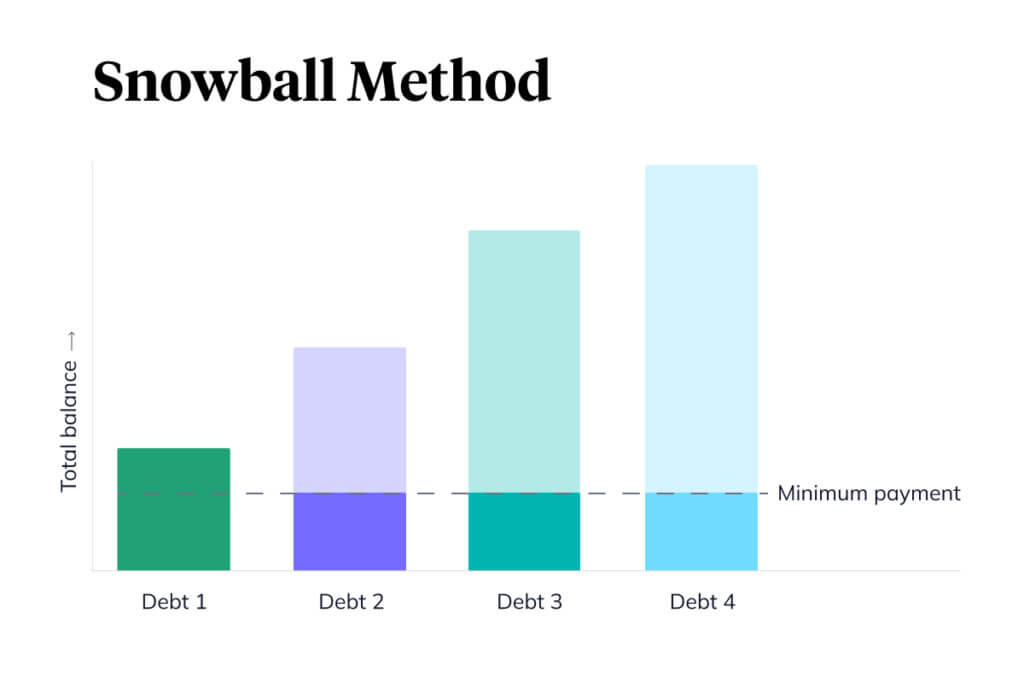

When it comes to how to pay off debt, there are a couple of different approaches you can take. They’re grouped into what’s known as the avalanche and snowball methods.

With the avalanche method, you make minimum payments on all of your debts, and then use any remaining funds to pay off the debt with the highest interest rate. This plan for paying off debt can make the most sense if you’re working toward a long-term goal rather than a short-term financial need.

The snowball method, on the other hand, means that while you make minimum payments on your debts, you then address the smallest debts before taking care of the larger ones. If you’re someone who is inspired to work toward goals by seeing smaller signs of progress along the way, this route might be more appealing to you.

To get a quick idea of which debts may make the most sense to prioritize, a calculator for debt payoff can help. You can plug your current debts, including interest rate and remaining balance, into our Cost of Debt Calculator and get a better idea of how much your obligations are setting you back — as well as how long it will take you to pay them off at your current rate. This tool is also helpful for figuring out which debts to pay off first.

Should I pay off my credit card in full? When should I pay off my credit card?

It’s typically best to keep your credit card paid off for a couple of different reasons. Not only will it help save you money you would be paying in mounting interest payments that add up each month, but unpaid credit card debt can also negatively affect your credit score. If you already have an outstanding balance that you’re able to pay off, it’s a good idea to start here as a first step.

Option 2: Build Your Savings

Choosing to save also has its benefits, however. You may be able to take advantage of compounding interest — the more time your money is in savings, the more your money grows.

You also have better control over your timeline this way, as you don’t have to wait until your debts are repaid to begin getting closer to your bigger goals.

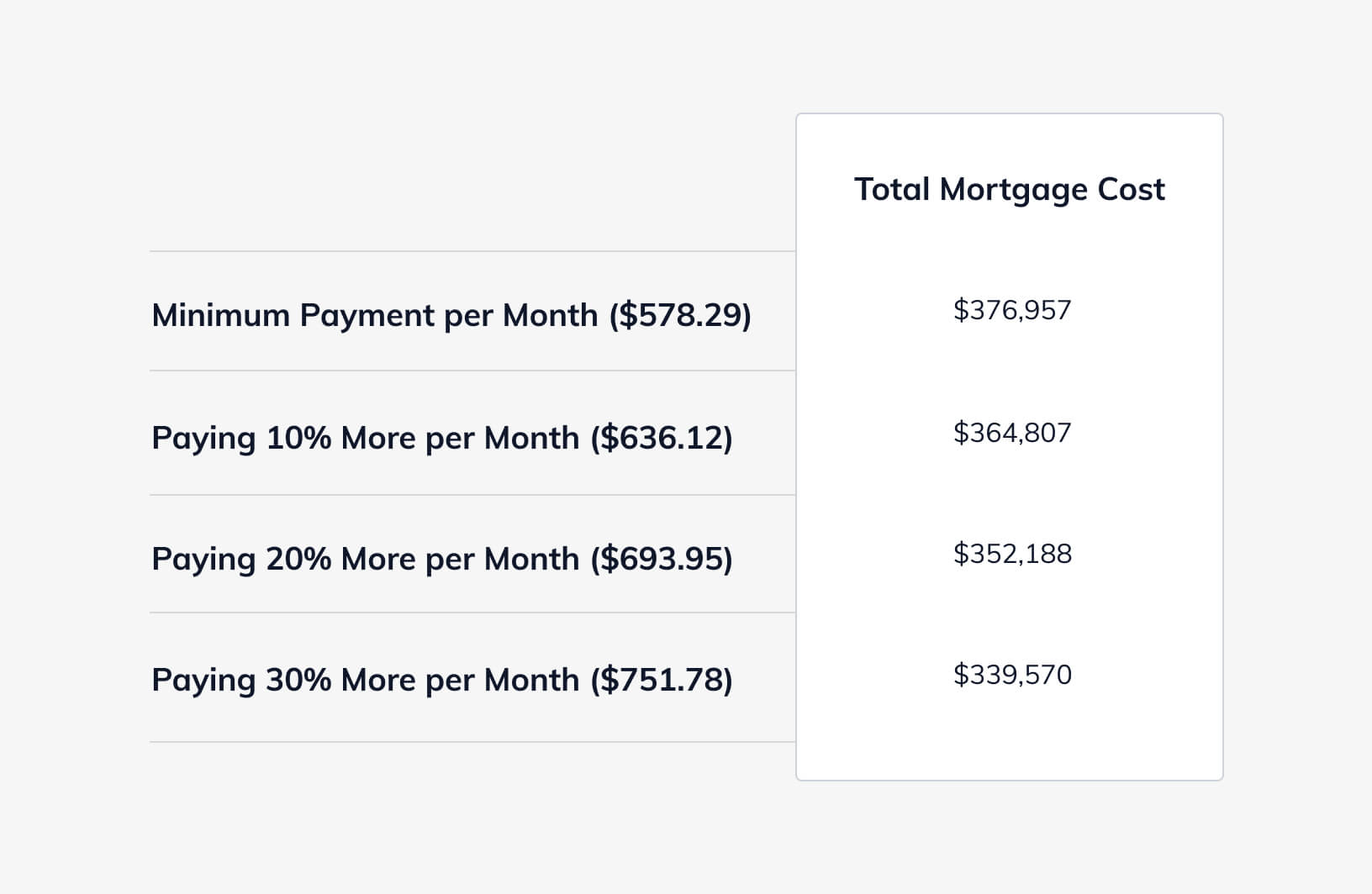

You’ll want to consider what you’re saving up for and whether right now is the best time to pursue it. If it’s your first home, other factors like the current market conditions and the cost of a mortgage versus renting come into play as well, and it may make sense to hold off and handle debts right away.

In any case, setting a target savings goal works toward either a debt payoff or savings strategy, so it often makes sense to begin here no matter what your ultimate objective is — and creating a savings account or emergency fund is a sound decision to avoid debt in the future.

One fairly quick and painless way to begin building your savings is to set up a direct deposit account that automatically puts a percentage of your paycheck into a designated account. If you’re able to afford it, even if it’s a small percentage of your paycheck to start, this can be a smart move.

Another way to save that might seem a bit counterintuitive is to spend money on home improvements that will improve your energy efficiency and cut costs down the road. Even if you don’t make full-scale updates, taking a look at your daily habits with respect to heating and cooling (for example, turning your thermostat down a few degrees or keeping the air conditioner off unless absolutely necessary) can slash ongoing bills and make a difference.

Should I pay off student loans or save?

It can be especially tricky to decide whether to prioritize student loan payments or begin saving, but the most important thing to consider is whether you currently have a comfortably padded emergency fund that will provide a safety net in case of an emergency, or even just a solid cushion in place to handle any major upcoming life events like a move, wedding, or higher education. You should also look at the current interest rates on your loans. If they’re pretty low, you can feel more comfortable starting to save and place your focus back on loans at a later time.

Should I use savings to pay off debt?

Again, it depends. While it can be tempting to dip into your savings to pay off debt, it’s recommended that you maintain a certain amount of emergency funds first before using savings towards debts. Otherwise, you might find yourself unprepared and without enough money to cover an unexpected or emergency situation that arises.

If you decide that paying off debt could help you take steps toward financial freedom, there’s an alternative option to traditional solutions, a home equity investment, that may be a fit. You’ll receive cash in exchange for a share of your home’s future value, and unlike loans for paying off debt, there’s no interest or monthly payments to worry about, so you can start eliminating it more quickly.

Are you a homeowner who could use some extra money to begin chipping away at debt or even add to your savings? Take our five-minute quiz to see if a Hometap Investment might be a good fit for you.

YOU SHOULD KNOW…

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.