With both inflation and interest rates hitting record highs in 2022, all American consumers were affected by the increases — but aspiring homebuyers and current homeowners were especially impacted. For the former, the soaring prices were discouraging developments that forced many of them to put their dreams of homeownership on hold indefinitely, while the latter saw all-time highs in equity that presented opportunities for them to reap the benefits of home appreciation by selling or finally putting renovation plans into motion.

While these factors will continue to play a pretty significant role in 2023, the year will also likely bring the rise of more solutions that help homeowners access funding without the stress of debt. Here’s a look ahead at what we think you can expect.

Homeownership Tenure Will Increase, Allowing Homeowners to Build More Equity

Though first-time buyers may still find themselves priced out of the market as interest stays high, current homeowners who opt to stay put and delay plans to move may have an advantage. While they wait out the rate hikes, they’ll earn more equity in their current home, put a dent in their principal, and experience home price appreciation. This might put them in a more favorable place to buy down the road.

As a byproduct of the reduced incentive to sell, homeowners are more likely to focus on and achieve other financial goals in the meantime, like paying down credit card debt, making much-needed renovations on their homes, or even starting a business.

Demand for Cash-Out Refinances Will Decrease

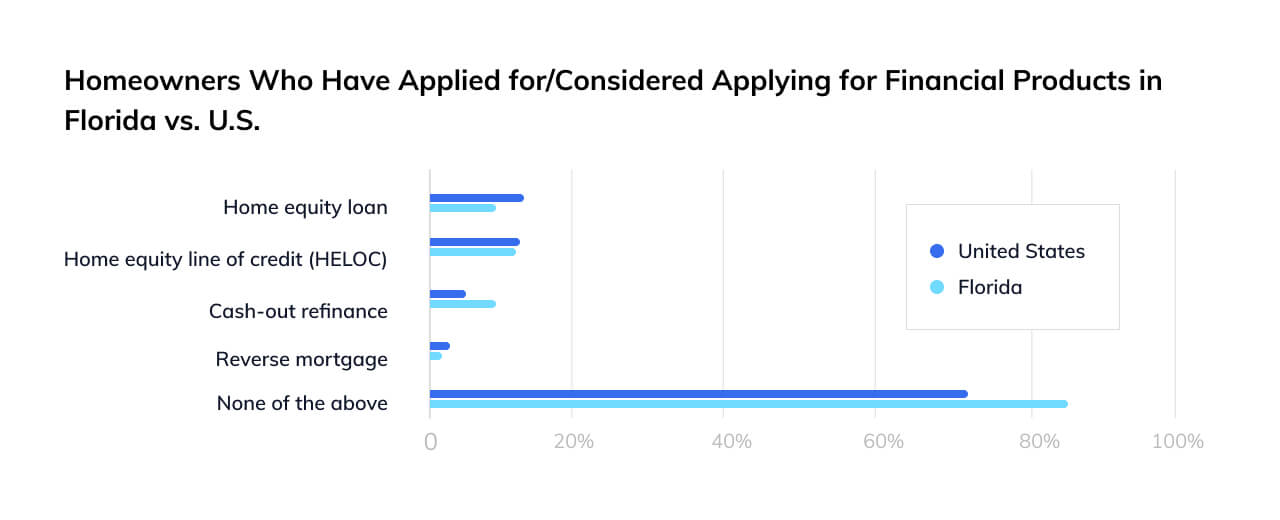

As inflation and interest rates increase, products like home equity loans and cash-out refinances that have fees, monthly payments, and/or interest attached are becoming increasingly less appealing to homeowners. And as a potential recession looms, homeowners are taking steps to minimize unnecessary spending and reduce their expenses in order to keep debt down in any way they can. We’ll likely see products that involve taking on debt decrease in popularity as a result.

To this end, consumers are expanding their search and considering alternative financing options that may have previously been quite unfamiliar. Among these solutions are home equity investments, which allow homeowners to access their equity without taking on monthly payments or interest. This is especially true when it comes to cash-out refinances, as the primary appeal of this solution is often to secure a better rate during low-interest periods; homeowners won’t want to run the risk of losing their current rate given recent hikes.

Small Business Owners Will Explore New Solutions for Funding

Not only are homeowners feeling the strain of rising interest rates; business owners are as well. While small businesses are booming, and poised to continue growing in 2023, financing products that cater to them — like business loans and credit cards — are rapidly becoming more expensive as a result of skyrocketing rates.

With consumers tightening their spending and potentially patronizing businesses less frequently in the past year or so, business owners will likely be looking for supplemental income to stay up and running during lulls. In addition, small business owners who are also homeowners have another source of start-up funding in the form of their homes. Home equity investments allow already cash-strapped business founders to access funding without the hassle of interest or monthly payments. And with the ability to use the money for whatever they’d like, the possibilities are virtually endless — from equipment or marketing to working capital.

If you’re a homeowner who wants to make the most of your growing equity, take our five-minute quiz to see if a Hometap Investment might make sense for you.

YOU SHOULD KNOW…

The above information is for general awareness and education purposes only, and does not pertain specifically to the homeowners insurance needs of those seeking a Hometap Investment. We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.