If you’re looking for ways to make your home a whole lot more energy-efficient and save some cash at the same time, solar panels might be a good option for you. The average American family can save more than $1,400 a year in electrical costs by adopting solar energy, and the savings begin as soon as the panels are installed.

There are many benefits to solar panels beyond the potential savings. One of the biggest is that they’re a renewable energy source, meaning that you can never run out of it. Another plus is that solar panel maintenance is fairly easy, requiring cleaning just a couple of times per year. Most systems come with a 20–25 year warranty, and the only part that will typically need to be replaced every 10–12 years is the inverter, which converts electricity. Below, learn about the cost of solar panels and some of your options to pay for them.

Are Solar Panels Worth It for Me?

If you’re considering the switch to solar energy, the first step is to make sure you’ll be saving more than you spend. The easiest and best way to do this is to take a look at your electric bill. Energy rates can fluctuate significantly over time, but if you notice a long-term trend of high bills, you might benefit from solar panels.

Of course, you’ll also want to ballpark the cost of the installation and purchase of panels. Just like any home service, these can vary by company, so it may be worthwhile to request estimates from multiple vendors in your area. Unfortunately, you do need a professional to help you — this is one area where DIY won’t cut it, and it’s worth the money to have a quality system correctly installed onto your house.

Finally, it may seem like a given, but the more sunlight your home receives, the more money you’ll be able to save with solar panels; this is why they’re more common in western states like Arizona.

With the overall cost of solar panels falling more than 20% in the past five years, it may be a good time for you to take the plunge. This AI-powered calculator can help you determine your home’s “solar potential,” including recommended system size, savings amount, and more.

The average post-tax credit cost for 10 kilowatt (kW) solar panel installation in the United States in 2021 ranges from $17,760 to $23,828. Per watt, that breaks down to $2.40 to $3.22. The pricing is dependent on a couple of different factors, including system size and panel brand, and of course, state. Cost by state ranges from $2.34 per solar watt in Kentucky to $3.16 in Washington, DC. In general, the larger the system, the less expensive it is to operate.

Solar Tax Credits and Incentives

While solar panels can be expensive, you can enjoy some discounts that cut the price down a bit. The Residential Clean Energy Credit offers a 30% credit to homeowners as of 2023 (up from 26% in 2022). In combination with the drop in panel cost from that of previous years, you have the potential to maximize your savings by transitioning to solar now.

There are some other state-specific tax benefits you may be eligible for, including sales tax exemptions, income tax credits or deductions, and property tax rebates or exemptions. Sales tax exemptions are fairly self-explanatory, with the state exempting the cost of energy-efficient purchases. Income tax credits for energy-efficient home improvements are available in several states to homeowners who don’t exceed a single or joint income threshold, and property tax exemptions, offered in 32 states including New York and California, provide reductions for a percentage of the cost of a solar energy system.

Leasing vs. Owning Solar Panels

One of the biggest decisions you’ll need to make when it comes to solar panels is whether you want to lease them or purchase them outright. Here are a few questions to ask yourself:

- Can I reap the financial benefits of solar energy in addition to the environmental ones?

- Am I willing to handle necessary maintenance and repairs of my system?

- Am I eligible for the tax credits that come along with solar?

If you answered “yes” to the above questions, owning your panels might be the best option — however, if you aren’t prepared to handle occasional maintenance, don’t want to wait until the following year to receive the kickback from tax credits, or are otherwise ineligible for these credits, it’s probably a better idea to lease.

Financing Solar Panels

There are a number of ways to handle the cost of solar panels. Let’s take a look at a handful of the most common ones.

1. Solar loan

As the name suggests, solar loans are specifically designed to assist with solar panels, and widely available. However, these loans vary widely by lender in terms of their APRs, fees, and funding timelines, so it’s important to do your homework if you decide to go this route.

2. Home equity loan

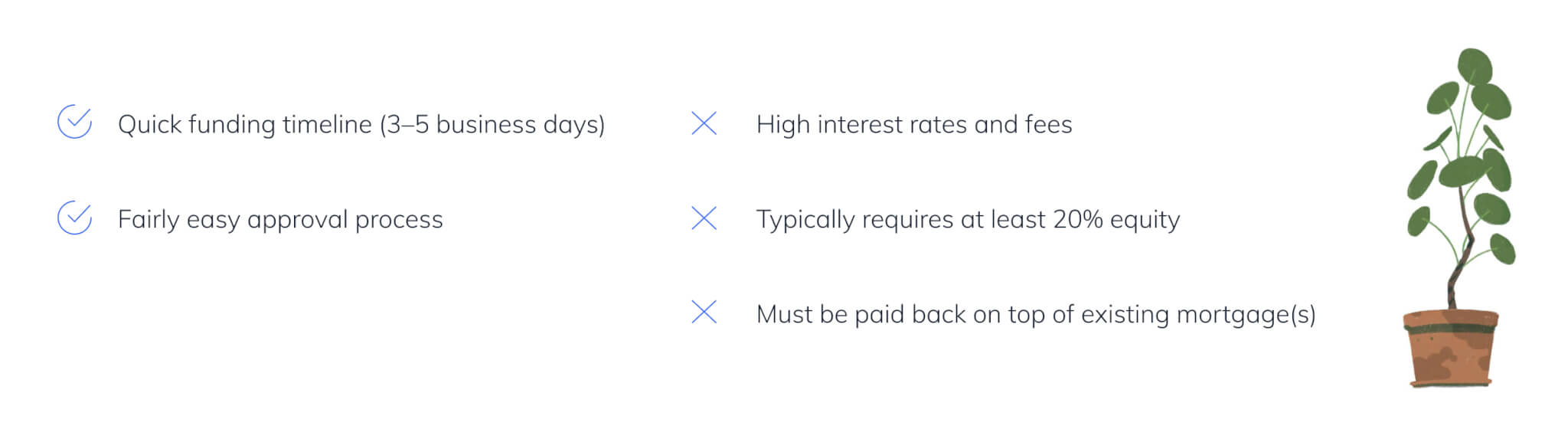

A home equity loan is one of the most common ways that homeowners finance their solar panel installation, as it provides cash in one lump sum and has a fixed interest rate. However, you still need to worry about making your mortgage payments on top of the loan, and depending on your lender, the application and approval process can be challenging.

3. HELOC

A home equity line of credit (HELOC) gives you flexibility when it comes to how much and how often you can access your funds, and has the potential to improve your credit score. On the other hand, the variable interest rate means monthly payments can fluctuate, and your lender can freeze your HELOC if your credit score or home value drops.

4. Government loan

There are also options for government assistance when it comes to financing solar energy updates. While there aren’t any federal government loans available on a wider scale — just the tax credits mentioned above — there are a variety of programs through various state and local branches that can help you with the move to solar energy if you live in a participating community. These include Green Retrofit Grants, the Tribal Energy Program, and High Energy Cost Grants.

5. Home equity investment

Finally, a home equity investment can help you cover part or all of the cost of solar panels for your home. You can access a portion of your home’s equity in a lump sum in exchange for a minority stake in the home’s future value. Since there aren’t any monthly payments or interest, you don’t need to worry about the hassle of extra costs, and you can get the money you need in as little as three weeks.

YOU SHOULD KNOW…

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.