If you’re ready to launch or grow your business, the financing options can feel overwhelming. The first step to securing capital is knowing about the best small business loans for small businesses—and the pros and cons of choosing one over the other.

Small Business Administration (SBA) 7(a) Loan

This small business loan program is the main way the SBA, a U.S. government organization, offers assistance to those looking to finance their company. These loans for self-employed individuals and small businesses provide up to five million dollars. While you’re restricted to business uses, you’re able to use the funds for multiple needs, including construction or renovation, working capital, inventory, or the purchase of land, buildings, and equipment.

Within the program are several loan types, with some eligibility decisions made by your lender and some made by the SBA. Loan amounts, terms, fees, interest rates, and more vary by the loan. For example, there are Veterans Advantage SBA loans that come with reduced fees and SBA Express loans that reduce the turnaround time for SBA review, as well as SBA Disaster Loans intended for businesses affected by the COVID-19 pandemic, natural disasters, or civil unrest. You’ll want to find an SBA-approved lender who can help you determine the best option for you.

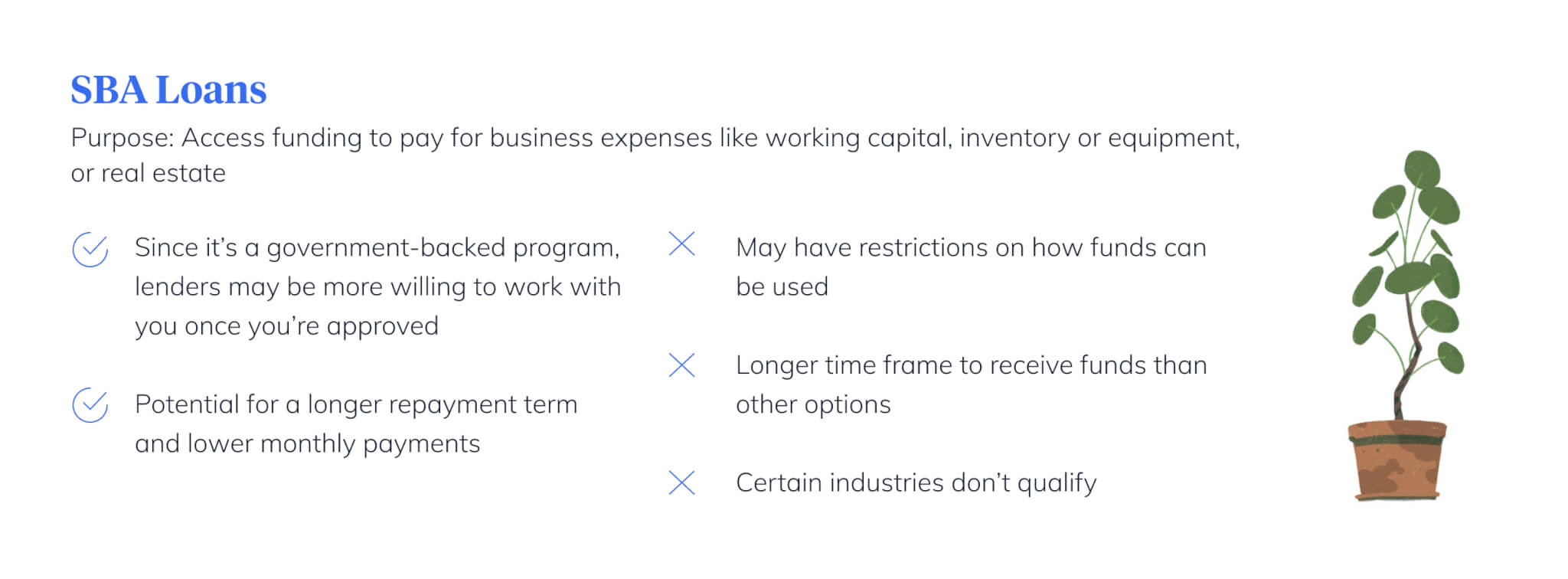

Pros:

- Because the program is backed by the government, it decreases the risk for the lender, making them more likely to work with you once you’re approved.

- Decreased lender risk also means you may be able to secure a longer repayment term, resulting in lower monthly payments.

- While interest rates vary by loan, they’re often quite low. “For a patient entrepreneur who has her ducks in a row and is willing to go through the process, it’s a lot cheaper capital,” says Bob Coleman, who publishes The Coleman Report, a popular SBA intelligence report.

Cons:

- Some lenders put restrictions on how you can use the funds.

- You’ll want to make sure if you’re using funds for things like fixed assets (equipment, remodeling) or to hire more employees, that your loan allows you to do so.

- SBA loans may take longer than another type of loan — often 60 to 90 days—and you’ll need a full business plan, financial statements, and business licenses, among other documents.

- Certain industries— gambling, firms involved with lending, and religious organizations, for example — don’t qualify for SBA loans.

Was your SBA loan application rejected? Read ‘4 Reasons Your Business’s SBA Loan Application Was Denied‘ to learn what to do next.

Merchant Cash Advance (MCA)

A merchant cash advance, also known as a merchant loan, is designed for businesses with credit scores that may have a difficult time securing a traditional loan. Similar to a small business payroll loan, you get a sum of cash in exchange for a share of your future credit or debit card sales that you repay with set withdrawals (plus fees) from your bank account, usually over a period of three months to a year. It can be a good option for those with less than stellar credit, since the potential to pay back the advance with sales is a more important criterion.

Plus, you can get money very quickly; usually within 48–72 hours of application.

“Merchant cash advances are engineered for speed,” according to Brock Blake, CEO and founder of small-business lending platform Lendio. “If your business has an urgent need, such as a crucial piece of equipment breaking or a lucrative opportunity to seize, an MCA will give you quick access to funds.”

Pros:

- Compared to your other options, an MCA is fast and requires minimal paperwork.

- If your repayment rate is based on a set percentage of your business sales, your monthly payment may be lower if your revenue decreases in a given month.

- You don’t have to back an MCA with collateral.

Cons:

- Depending how fast you pay it back, you may face massive APR — as high as a whopping 350%.

- If you’re paying back with a percentage of debit and credit card sales, you can face higher APR if your sales skyrocket.

- There’s no federal regulation or oversight, since an MCA is technically a commercial transaction instead of a loan.

- It’s hard to really determine what the MCA will cost you—and if it’s worth the risk of falling into deeper debt.

Crowdfunding Loan

Crowdfunding allows you to set up a campaign online with your fundraising goal and request money for a specific project. Typically, you’ll offer something to supporters in exchange for their contribution. That may be your product or service, or it may be a share of stock in your company.

While there’s no guarantee that your crowdfunding campaign will be successful — many companies have failed to reach their goal — there are also a number of well-known companies like Pebble and Oculus that got their start this way.

“Crowdfunding works for all kinds of companies at all different stages,” says CEO of crowdfunding platform Republic, Kendrick Nguyen. “But the companies that have the most successful campaigns tend to have the largest and most engaged communities behind them — usually of customers or users or other supporters of their mission.”

Similar to crowdfunding, peer-to-peer lending sites like Lending Club help connect established businesses to investors. It works somewhat like a loan in that you’ll pay interest and have a three- or five-year repayment period. However, instead of financing your loan, Lending Club simply services it. The site’s investors choose whether or not to invest in your loan.

Pros:

- Some crowdfunding sites allow you to repay investors with products or services instead of with cash.

- Depending on your project, there may be fewer barriers to entry and the process is often quicker than traditional loan processes.

- It can be a good way to test the market and gauge the demand for your business before building it out.

Cons:

- You may face tax obligations.

- While you can promote your campaign via your social and professional networks, there’s no guarantee your campaign will succeed — investors aren’t guaranteed.

- For some platforms, if you don’t reach your goal, you don’t access the funding.

- If your campaign doesn’t get adequate exposure, it may lead you to falsely conclude that there’s not enough interest in your product or service.

Small Business Equipment Loans

If you need an expensive piece of equipment or machinery — for example, manufacturing lines, company cars, or restaurant ovens — you may look into a small business equipment loan. Equipment loans are designed to help you cover the cost of adding new equipment and/or replacing old, outdated equipment that is too costly to repair.

Equipment loans are available through traditional lenders like banks, as well as online lenders. Some SBA 7(a) loans, as well as its 504 loan program, offer loans for equipment. It’s important to make sure that the loan amount and effective period line up with the equipment’s cost and your timeline for its use, so you’re not pressured to pay back the loan too quickly or for far longer than you needed the equipment.

“On one hand, a longer loan term will result in lower monthly payments,” says Tom Ware, senior vice president of analytics and product development at PayNet Inc. “On the other hand, a term that is longer than the useful life of the asset will result in payments still having to be made in the future, after the asset is no longer of value.”

Pros:

- Often better rates compared to other loans.

- Tax benefits, like deducting the interest you’ve paid and claiming depreciation.

Cons:

- Some lenders may require you to have been in business for a set period of time before offering this type of loan and will likely want to see cash flow statements.

- Your equipment serves as loan collateral, so you can lose it if you default on the loan.

If the equipment you need will likely become outdated fast, you may find leasing is a better option. The Equipment Leasing and Finance Association recommends leasing only if you plan to use the equipment for three years or less. You likely won’t need a down payment, either, so this can be a good choice if capital is tight.

Looking for Options Specific to Your Business? Read: The Best Small Business Loans for Niche Entrepreneurs

Using Your Home Equity to Fund Your Business

If you are a business owner and a homeowner, you have an additional option: Tapping into your home equity. Many business owners think twice about options like a home equity line of credit because there is the possibility of losing your house. This is particularly true if you’re just launching a business, as there’s no guarantee it will take off.

But a home equity investment can give you the capital you need now in exchange for a share of the future value of your home. Since it’s an investment, not a loan, you have no monthly payments or interest. Once the term is up, you can either buy out the investment or simply repay it when you sell your home.

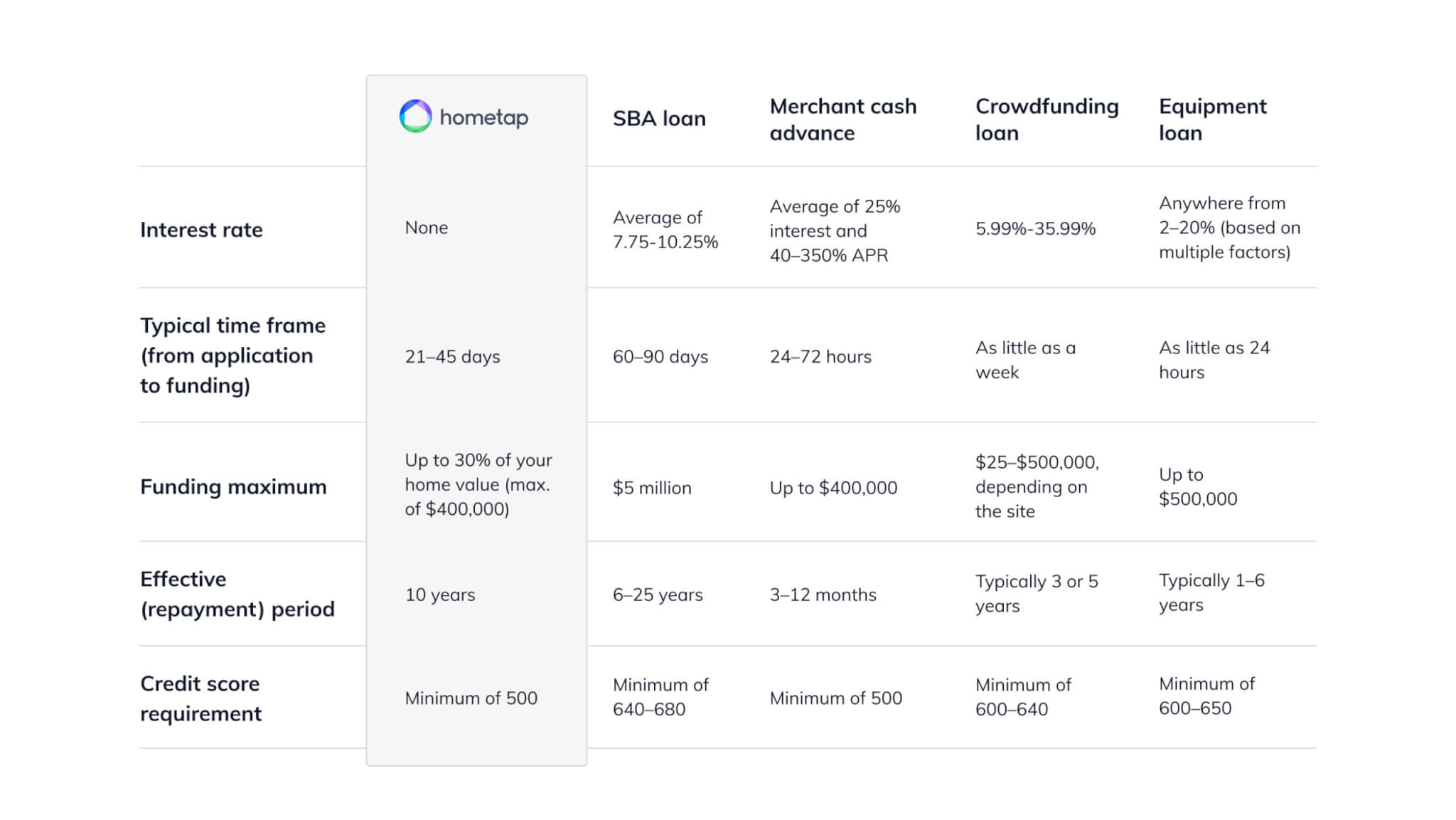

No matter what option you use to start or grow your small business, you’ll want to carefully weigh your options and get the help of an expert to make sure you’re choosing the one that will best position you for personal and professional success. Use the chart below to weigh your options.

Take our quiz to see if a home equity investment is a good fit for you and your business needs. It takes less than five minutes to complete and could provide up to $400,000 in cash in as little as three weeks.

YOU SHOULD KNOW…

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.