So your application for a Small Business Administration (SBA) loan was denied. Unfortunately, you’re not alone.

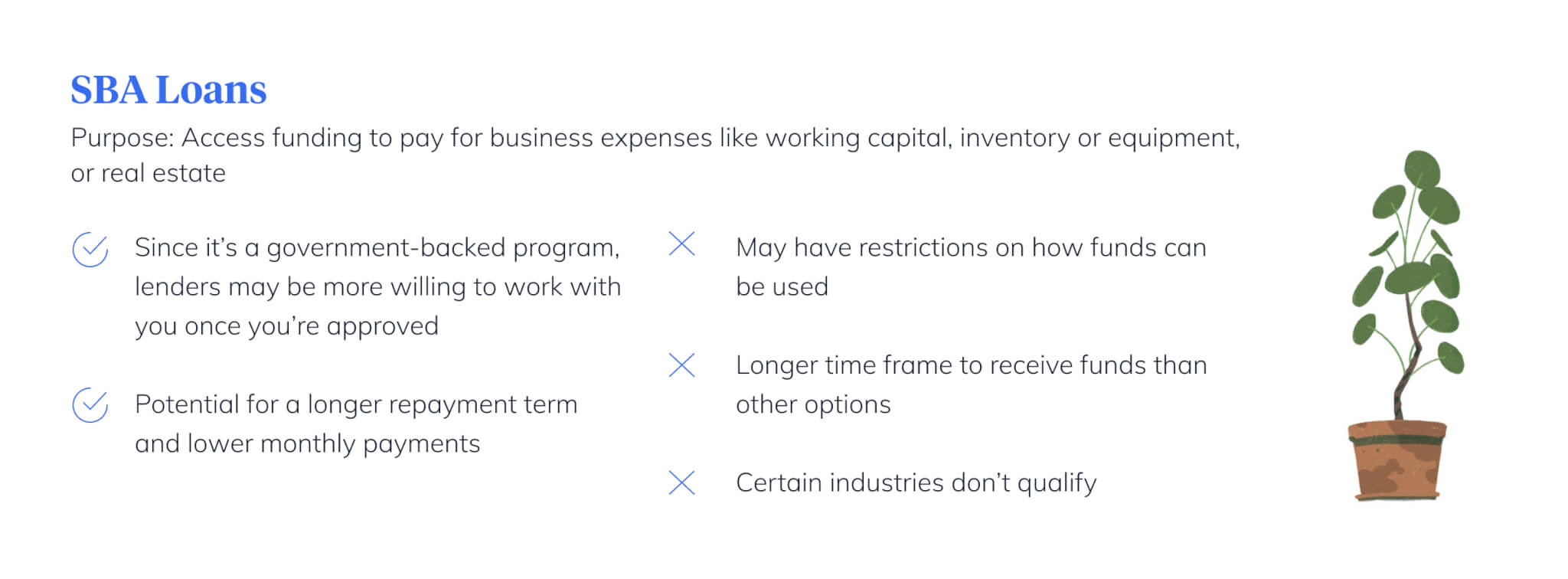

If you’re a small business owner, an SBA loan can be a lifesaver, providing you with the funds you need to get — or stay — up and running, offering up to five million dollars for capital and expenses. There are a few different loan types that cater to different types of businesses, including 7(a), 504, and microloans.

The only problem? The restrictive criteria makes it quite difficult to qualify for a business loan in the first place. The approval rate can be as low as 25% at some banks. It’s easy to see why the top reason businesses fail is cash-flow, and 30% of small businesses are forced to call it quits in year two. Understanding why your application was rejected and what steps you can take to secure funding are key to your business’s success.

Reasons your application for an SBA loan was denied can run the gamut from more obvious ones to others that might not be so apparent. Some members of the Hometap team have experienced the small business loan application process firsthand, from both the lending and applicant side, so we chatted with them about the major pain points. Here’s a rundown of the most common reasons for rejection, and what you can do to access the funding your business needs.

1. You Haven’t Been in Business Long Enough

Small business loans can be especially difficult for start-ups that need funding to scale. It’s generally recommended that you have at least three months worth of financial records to share when applying for a loan. According to Hometap’s Senior Sales and Marketing Operations Manager, Olin Nelson, who previously owned a small coffee business, it often takes more than that.

“You really need at least two years of profit and loss documentation, so lenders can get a good picture of your revenue over an extended period of time,” he explained.

Hometap Investment Manager Bryan Barry agrees; during his time in the lending space, one of the biggest reasons he saw applications get rejected was that the applicant had only been in business for a short time.

“Less than three years in business was a cause for rejection,” he shared, adding that it was common for applicants to be rejected from multiple lenders as well. “I’d see business owners who had been rejected three or four times before coming to us,” he said, underscoring the difficulty of clearing these application hurdles. While this is partially related to credit score (as we’ll get into below) your business’ credit or profit history may be too limited for lenders to feel confident, even if your score is strong.

2. You Have Bad (Or Limited) Credit

One of the most common causes for application rejection is a low credit score (this all depends on the specific lender, but 640–680 is a good minimum to aim for). However, you can also run into issues if your credit history — whether personal or business — isn’t extensive enough, as demonstrated above. If you’ve recently declared bankruptcy, this decreases your likelihood of being approved as well. Nelson also warns against buying into advice that glorifies ‘bootstrapping’ — or relying completely on your own personal credit and money to get started.

“A lot of small business resources encourage people to keep financing in-house, open credit cards to get started, and buy initial inventory that way, but this can really hurt your prospects for getting funding,” he explained. “Your debt-to-income ratio is going to increase, and that can have a negative impact when you go and try to get a traditional loan after that.”

3. You Have a Low Capacity for Repayment

If a lender believes that you may not be able to repay your loan for any reason, they may deny your application. This can happen if you’ve already taken out another loan elsewhere, if you don’t have much (or any) business or personal collateral, or if your business revenue or capital appears insufficient to cover the balance of the loan. Previous financial documentation that shows evidence of positive historical performance, as mentioned above, increases the likelihood that lenders will feel confident about getting their money back.

“You really need some money upfront,” said Nelson. “I was denied for five different loans in my first year of business because my capital needs to scale the business grew much faster than the purchase orders I was getting. When you don’t have consistent income history, and a bank is willing to help, they’ll require 20-30% down on a loan. When you’re trying to quickly scale a business, and reinvesting profits, it’s difficult to save the cash you need to qualify, and lenders won’t cover things like employee salaries or operational capital because they’re not asset-backed or profit-generating.”

4. Your Industry Is “Risky” or Otherwise Ineligible

Lenders tend to be more reluctant to take on businesses that fall into categories that they deem to be higher-risk. These can include restaurants, used car dealerships, racetracks, and casinos. Barry added that in his experience, “some construction companies were risky because it can often take them 30, 60, or 90 days to get paid on projects.” Other ineligible industries are consumer and marketing cooperatives, rare coin and stamp dealers, and nonprofits. There are additional restrictions on religious organizations due to the separation of church and state.

What to Do if Your Small Business Loan is Rejected

Reapply

Once 90 days have passed from the date your SBA loan application was rejected, you can reapply if you feel that you’ve addressed the issue(s) that led to the rejection — fortunately, this should be quite easy to find out, as federal law states that you’re legally entitled to a written letter of explanation for the rejection. Common steps include strengthening your personal and business credit score and ensuring that your company’s financials are in tip-top shape. In cases where you were rejected due to limited time in business, your best bet may be simply to wait at least a few months.

Consider Alternatives to a Small Business Loan

If your SBA loan was denied, another route is to think about alternatives to a small business loan. A home equity investment, like those offered by Hometap, can be an ideal option for small businesses whose SBA loan application was denied or who don’t meet the criteria for approval.

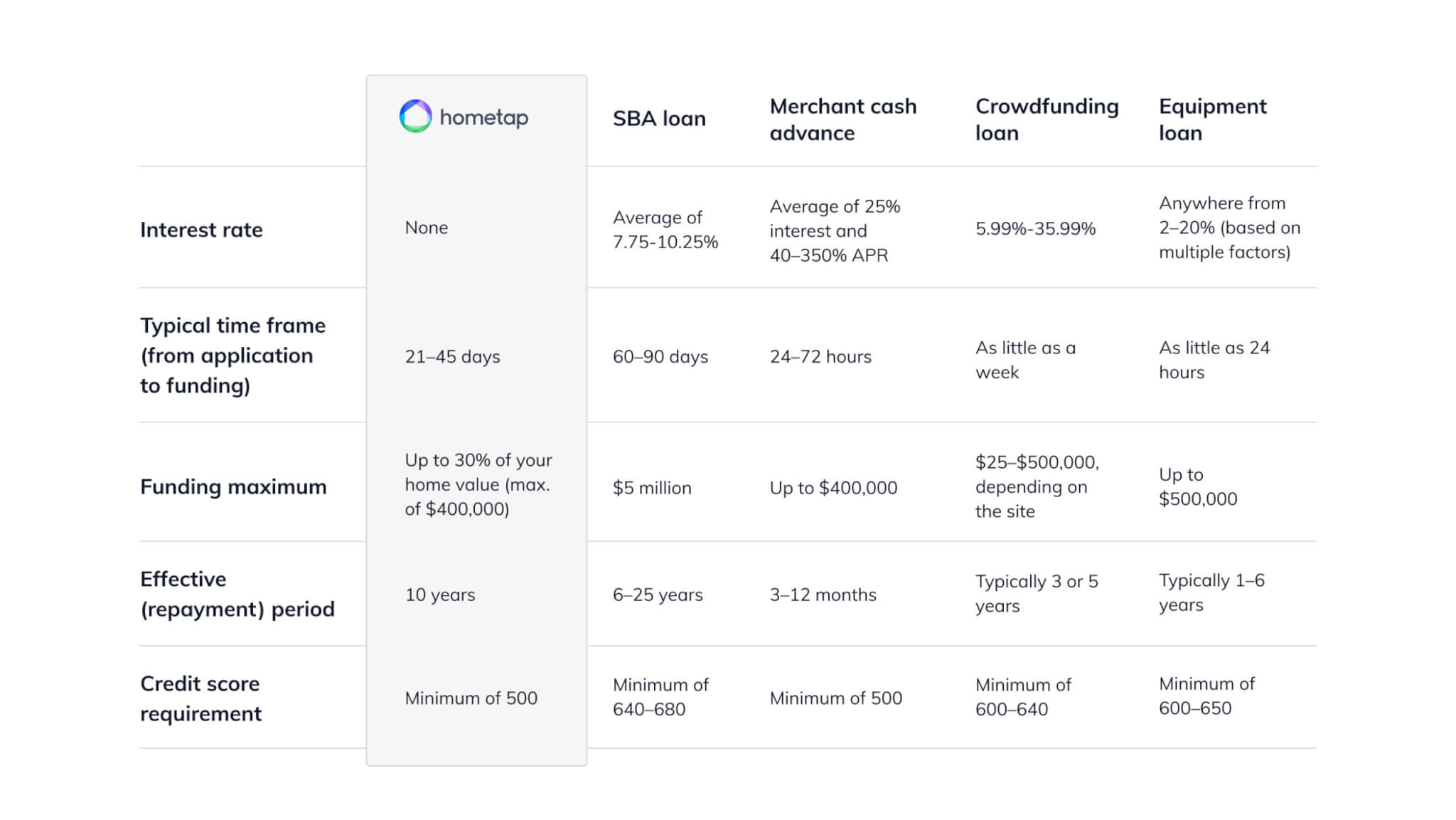

While a traditional small business loan may allow you to get a low rate, it may not be the best choice if you’re looking to get funding quickly; the loan process can take up to three months and require a site inspection and hard credit pull, whereas a Hometap Investment can get you funds in as little as three weeks. In addition, there are more restrictions that come along with an SBA loan in terms of the use of funds: while you might be limited to equipment purchases, building renovations, or furniture and fixtures, a home equity investment allows you to use the money for whatever you’d like without these often rigid requirements.

Learn firsthand how a Hometap Investment can help from Massachusetts homeowner Michael M., who used his home equity to expand his business.

While a home equity loan may offer another alternative way for entrepreneurs to access funding, many self-employed homeowners find it difficult to get approved due to the lack of a standard W2.

“Hometap would have been a godsend for my business because of the flexibility it offers,” Nelson said. “With a home equity investment, you can fund that next stage of growth, unlock more channels, and have a reserve of capital when opportunity strikes. When you’re a small business that’s having to pay the debt and interest that comes with a traditional loan on top of already razor-thin margins, it can be a huge challenge.”

See how a home equity investment from Hometap compares to an SBA loan in the chart below:

While it might not be the best fit if you need a large amount of capital, a Hometap Investment offers a shorter funding timeline, no monthly payments or interest, and no criteria on how you spend the money.

See if we’re a fit for your small business needs.

YOU SHOULD KNOW

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.